Exploring the opportunities and challenges for NRIs investing in Indian Real Estate.

Introduction: Investing in Indian real estate has long been an attractive prospect for Non-Resident Indians

(NRIs) seeking to diversify their investment portfolios and maintain ties with their homeland. However, while

India's dynamic property market offers promising opportunities, navigating the intricacies of real estate

transactions from abroad presents its own set of challenges. In this blog, we will delve into the potential benefits

and obstacles faced by NRIs when investing in Indian real estate.

Opportunities for NRI Investments:

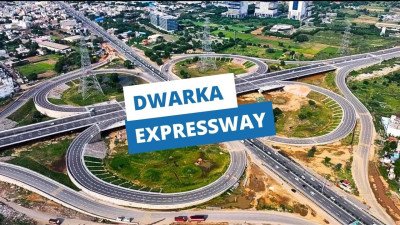

Economic Growth: India's burgeoning economy presents abundant investment prospects across

various sectors, including real estate. The country's rapid urbanization, infrastructure expansion, and

rising disposable incomes have spurred demand for residential, commercial, and retail properties.

Demographic Advantage: With its large and youthful population, India has a significant need for

housing, particularly in urban areas. NRIs can capitalize on this demand by investing in residential

projects targeting the burgeoning middle class and urban professionals.

Return on Investment: Indian real estate historically offers attractive returns on investment,

particularly in prime locations and emerging markets. NRIs stand to benefit from both capital

appreciation and rental income, especially in cities experiencing rapid growth and development.

Portfolio Diversification: Investing in Indian real estate allows NRIs to diversify their investment

portfolios, mitigating risk and potentially enhancing long-term returns. Real estate often serves as a

hedge against inflation and market volatility, offering stability to investment portfolios.

Cultural and Emotional Connection: For many NRIs, investing in real estate in their homeland goes

beyond financial considerations. It provides a tangible link to their roots, fostering a sense of

belonging and allowing them to contribute to the country's progress.

Challenges Faced by NRI Investors:

Legal and Regulatory Complexity: Understanding and complying with India's legal and regulatory

framework governing real estate transactions can pose challenges for NRIs. Familiarity with

regulations such as the Foreign Exchange Management Act (FEMA), Reserve Bank of India (RBI)

guidelines, and property laws is crucial to avoid legal complications.

Documentation and Verification: NRIs often encounter difficulties with documentation and property

verification when purchasing real estate in India. Dealing with paperwork, obtaining necessary

approvals, and ensuring the authenticity of property titles remotely require careful attention and

professional assistance.

Property Management: Managing and maintaining property from a distance can be challenging for

NRIs. Tasks such as finding reliable tenants, collecting rent on time, and overseeing property upkeep

necessitate effective communication and coordination with local agencies or property managers.

Currency Fluctuations: Currency exchange rate fluctuations can impact the value of NRI investments

in Indian real estate. NRIs must consider currency risk when repatriating funds, refinancing loans, or

selling property, as exchange rate movements can affect investment returns.

Market Volatility and Risks: Indian real estate, like any investment, is subject to market volatility and

risks. Economic downturns, regulatory changes, political instability, and unforeseen events can

influence property prices and rental yields, affecting NRI investments.

Despite the challenges, investing in Indian real estate offers NRIs a wealth of opportunities for portfolio

diversification, wealth creation, and emotional fulfilment. By gaining a thorough understanding of market

dynamics, staying abreast of regulatory requirements, and seeking expert guidance, NRIs can navigate the

complexities of real estate investment in India successfully. With careful planning and strategic decision-making, NRIs can harness the potential of India's vibrant property market to achieve their investment

objectives and strengthen their ties with their homeland.